The Global Financial Crisis was the most significant financial crisis to hit the world’s economies since the Great Depression. The crisis was precipitated by the effects of the U.S. subprime mortgage crisis, which spread throughout the U.S. and then the world’s financial systems. As the housing market began to cool, default rates on subprime mortgages increased substantially. Financial companies and investors became worried that they did not know exactly where the risks of subprime mortgages had been distributed because of securitization, a process where mortgages were combined into mortgage-backed securities (MBS) and sold to investors.

The concerns regarding real estate assets caused banks to contract their lending because they might need their cash to meet their own needs. However, many financial companies operated their businesses with high leverage, borrowing billions of dollars each day, so the liquidity freezes had a crippling effect, as did uncertainty regarding the declining or uncertain value of real-estate related assets, which were widely held. Because MBS were held by investors all over the world, and the financial system is highly interconnected, these issues spread through the world’s major economies.

When the investment bank Lehman Brothers failed in September 2008, it sent a shock through the already weakened financial system. Within a month the government had recapitalized American International Group, guaranteed money market mutual funds, and passed the $700 billion Troubled Asset Relief Fund, which permitted the government to invest capital into the country’s largest banks forestalling their failure. The crisis would worsen throughout the next year spreading beyond the financial system and impacting almost every segment of the economy. Governments around the world would make unprecedented interventions to address it. By 2010, the crisis was largely over in the U.S., but significant impacts on foreign economies were still to come as the Sovereign Debt Crisis developed in Europe. The crisis spurred policymakers to rethink how they regulated the world’s financial systems and many countries passed new legislation aimed at avoiding a repeat of the crisis that almost caused the major economies of the world to melt down.

Overviews |

YPFS Case Studies |

|

|

The Bankruptcy Examiner's Report |

|

|

Anton Valukas, Esq., Chairman of the law firm Jenner & Block, was appointed as Examiner in Lehman’s Chapter 11 bankruptcy case with the duty to “investigate the acts, conduct, assets, liabilities, and financial condition of the debtor, the operation of the debtor’s business and the desirability of the continuance of such business, and any other matter relevant to the case or to the formulation of a plan [unless ordered otherwise]” including investigating ten specific topics specified by the court. The Lehman Brothers bankruptcy was the largest bankruptcy of any American company.

Over 14 months Valukas and his team examined approximately 34 million pages of documents and interviewed more than 250 former Lehman management and employees, government regulators and other involved parties, such as several Lehman creditors. The result was a 2,200 page report, accompanied by 2,000 pages of appendices, issued in 2010. The report sheds light on many aspects of Lehman’s operations during the years leading to its demise that had not been publicly known. Notably, the Examiner’s Report first revealed Lehman’s aggressive use of Repo 105 transactions to buffer its reported leverage ratios and its lack of adherence to its risk management standards. |

Access the Examiner's report:

|

What Caused Lehman's Decline and Failure |

Questionable Accounting & Disclosure |

|

Many factors have been identified as contributing to the demise of Lehman Brothers and its ultimate failure. These include (1) high leverage, (2) poor controls and risk management, (3) high real estate concentration, (4) questionable accounting and poor disclosure, and (5) weak government oversight. These issues led to the firm experiencing a lack of confidence by investors and creditors and a liquidity crisis, which ultimately caused its demise. |

The Bankruptcy Examiner’s report revealed Lehman’s use of aggressive financing and accounting measures-Repo 105- to distort its leverage and net worth. |

High Leverage |

Poor Controls and Risk Management |

|

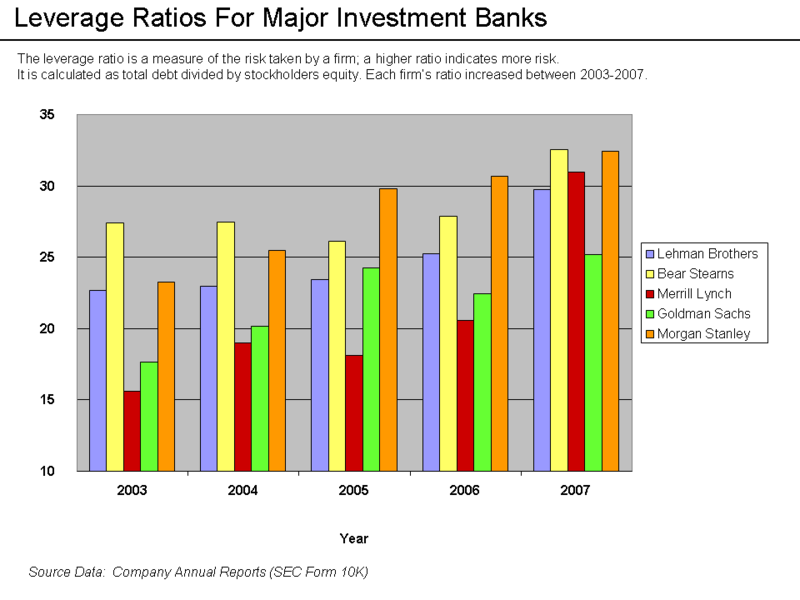

Like its peer investment banks, Lehman pursued a high-leverage business model that required it to borrow billions of dollars to fund its balance sheet. Much of it was short-term debt that had to be rolled over daily. Mounting cost and collateral requirements lead to a severe liquidity crisis in September 2008.

|

A companies’ operating structures, policies and procedures, and controls are only good if they are followed. In the wake of its bankruptcy, it was revealed that Lehman turned its back on its risk management controls, flexed other internal policies, used accounting “gimmicks” and withheld some information from its board. One or more of these practices might have contributed to its demise.

|

Weak Government Oversight |

The Federal Reserve and Lehman |

|

Lehman Brothers was regulated under a program supervised by the Securities and Exchange Commission (SEC). The consolidated enterprise was established in 2006 to help the independent investment banks avoid becoming subject to European Union regulation. Only the four independent investment banks were ever supervised under the program, which was criticized by many. The program was terminated in October 2008, after the last two investment banks became bank holding companies subject to regulation by the Federal Reserve. |

Although it had provided funding to Bear Stearns in March 2008, and announced its willingness to lend to Fannie Mae and Freddie Mac in July, the Federal Reserve did not fund Lehman in September. It determined that the investment bank did not have adequate collateral to support a loan of the size needed to save it. This lead to the firm filing for bankruptcy, which sent a shock throughout the world’s financial systems. Lehman Brothers was the only major U.S. nonbank financial company to fail during the GFC.

|

Selected Key Documents |

|

Timeline |

SIPA Liquidation of Lehman U.S. Broker-dealer |

|

As part of its proceedings, the Financial Crisis Inquiry Commission prepared an extensive Chronology of Events leading up to Lehman's filing for bankruptcy. The 322-page chronology is annotated and includes links to referenced primary documents. |

Lehman Brothers Inc. (LBI), Lehman’s U. S. broker-dealer, was excluded from the parent company’s bankruptcy to permit it to wind down its business and possibly be purchased. On September 19, 2008, the company initiated a liquidation action pursuant to the Securities Investor Protection Act (SIPA). James W. Giddens, Esq., of Hughes Hubbard & Reed LLP, was appointed trustee for the estate and produced a 200-page report. The report found that the lack of planning that went into the bankruptcy, the interconnectedness with the parent corporation, and aggressive protective actions by third parties made it particularly difficult to address LBI's individual needs before and during liquidation. The proceeding was the largest and most complex stock broker liquidation in U.S. history and one of the largest and most complex insolvency proceedings of any kind.

|

Selected Academic Papers Addressing Lehman |

|

Copyright 2019 Yale Program on Financial Stability |