Overviews

|

YPFS Cases

|

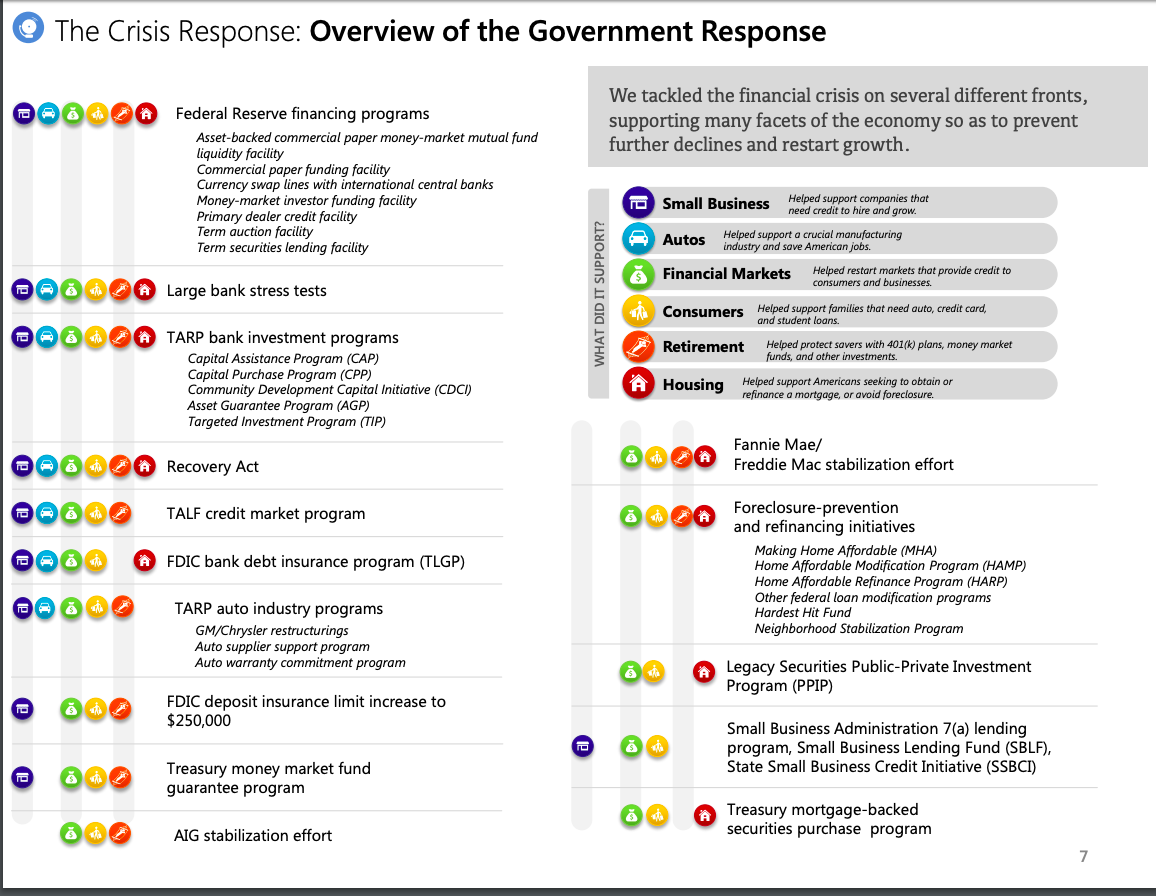

- “Overview of the Government Response,” p 7, The Financial Crisis Five Years Later: Response, Reform, and Progress In Charts

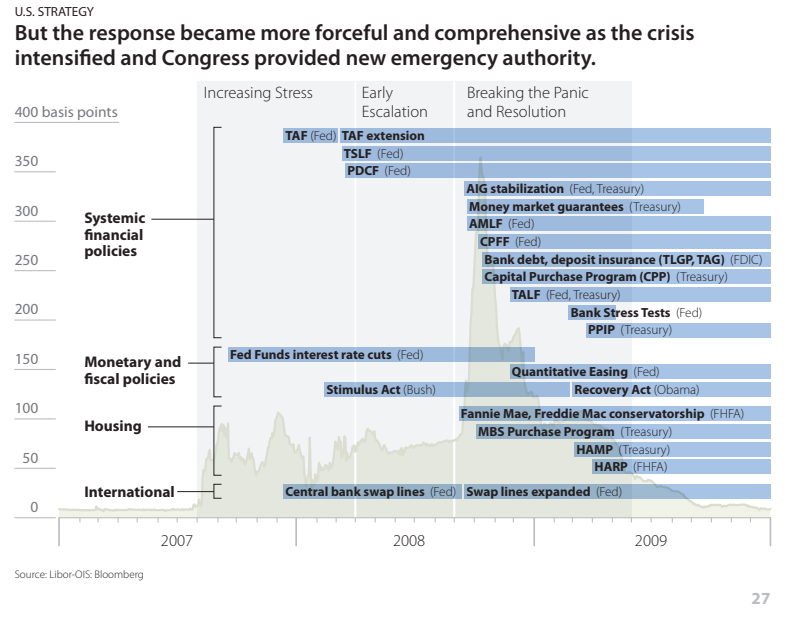

- “The US Strategy,” p 24 Charting the Financial Crisis

- “Overview,” Crisis and Response An FDIC History, 2008–2013

- “The Great Recession,” History

- “U.S. Government Responses to the Financial Crisis from September 1, 2008 to March 2009,” The Investment Company Institute

|

|

Timelines

|

Books

|

|

|

|

Federal Reserve's Response

|

Treasury's Response

|

- The Federal Reserve (also known as the Fed) is the central bank of the United States. During the crisis, the Chairman of the Fed was Ben Bernanke.

- The Fed oversees the country’s monetary policy in order to help achieve the congressionally mandated goals to maximize employment, stabilize prices, and moderate long-term interest rates. The Fed also supervises banks to ensure the safety and soundness of the banking system, and it helps maintain the stability of the financial system in part by containing financial systemic risk.

- During the Financial Crisis, the Fed was especially important as a Lender of Last Resort. This meant that depository institutions could borrow money from the Fed even when they could not borrow money anywhere else. During regular times, the Fed could only lend to traditional depository institutions (e.g. commercial banks, credit unions, savings and loans banks).” During the Crisis however, the Fed used its emergency power for the first time since the Great Depression to lend to financial companies that were not depository institutions (nonbanks), like broker-dealers, investment banks, and mutual funds.

- In 2007, the Fed attempted to stabilize the economy using its traditional methods, such as increasing liquidity and lowering interest rates.

- In 2008, the Fed started to use more nontraditional emergency methods, beginning with its assistance of Bear Stearns, the fifth largest investment bank, in March 2008.

- After the September 2008 collapse of Lehman Brothers (the fourth largest investment bank and the first major nonbank to fail), the Fed used its emergency powers to make unprecedented liquidity facilities widely available. It loaned trillions of dollars to banks and nonbanks in the U.S. and around the world to maintain the value of the dollar, stabilize the financial systems, and support the economy.

- YPFS Research Guide: The Federal Reserve’s Response

- Federal Reserve Website: Expired Policy Tools (including the Fed’s Financial Crisis Financing Programs)

- Federal Reserve Website: Crisis Response

- Speech by Ben Bernanke: The Crisis and Policy Response

- Lecture Ben Bernanke: The Federal Reserve's Response to the Financial Crisis

- Federal Reserve Bank of New York Website: Credit and Liquidity Programs Archive

- Federal Reserve Bank of New York Chart: “Forms of Federal Reserve Lending”

|

- The US Treasury Department is the country’s Executive fiscal authority. The Secretary of the Treasury during the start of the crisis was Henry Paulson. On January 26, 2009, former President of the Federal Reserve Bank of New York (FRBNY) Timothy Geithner succeeded him as Secretary.

- Throughout the crisis, the Treasury worked closely with the Federal Reserve, and the FRBNY, especially on early liquidity issues. It coordinated with these and other agencies such as the FDIC, and the FHFA to coordinate an overall response to save the financial system from collapse and protect the economy.

- The Treasury itself had little legal authority to take action itself and very limited funding authority until Congress passed the Troubled Asset Relief Program (TARP) in October 2008.

- Secretary Paulson played a major role in the passage of TARP, which provided $700 billion for the Treasury to use to fight the crisis.

- In addition, Secretary Paulson provided critical assistance in the passage of new legislation (the Housing and Economic Recovery Act (HERA)) which allowed Fannie Mae and Freddie Mac to be taken into conservatorship. Treasury was also instrumental in supporting a number of initiatives relating to stabilizing the housing market and other industries such as the auto industries.

- YPFS Research Guide: TARP

- YPSF Research Guide: Fannie Mae and Freddie Mac

- TARP Monthly Reports

- Treasury Website: TARP Programs Overview

- Treasury Website: TARP Programs Directory

- Treasury Website: TARP Bank Investment Programs

- Treasury Website: TARP Auto Industry Programs

- Treasury Website: TARP Credit Market Programs

- Treasury Website: TARP Housing Programs

- Treasury Website: TARP Regulations on Executive Compensation

|

FDIC's Response

|

Other Specific Government Actions

|

- The Federal Deposit Insurance Corporation (FDIC) promotes public confidence in the U.S. financial system by insuring deposits in banks up to a certain amount, by addressing risks to deposit insurance funds, and by managing the economic effects of a bank failure. During the Crisis, the FDIC Chair was Sheila Bair.

- The FDIC implemented a number of important programs to stabilize the banking system. It invoked the “systemic risk exception” under the Federal Deposit Insurance Corporation Improvement Act of 1991, which permitted it to veer from its “least-cost” requirement when addressing failing banks.

- Under the auspices of the SRE, the FDIC implemented two programs: (1) the Debt Guarantee Program (DGP), that extend the FDIC’s guarantee to newly issued debt instruments of FDIC-insured institutions, their holding companies, and their affiliates; and (2) the Transaction Account Guarantee Program (TAGP), which provided unlimited deposit insurance coverage of non-interest-bearing transaction accounts. The DGP and TAGP were integral parts of a broad government response to systemic risk in the banking system and are considered successful elements thereof. Under the DGP at peak utilization, the FDIC guaranteed approximately $350 billion in newly issued bank debt. Under the TAGP the FDIC guaranteed until year-end 2010, approximately $800 billion held in non-interest-bearing transaction accounts at participating banks, offering insurance over the statutory amount and deterring runs. The fees collected for the programs exceeded any losses covered by the government.

- In addition, the FDIC used its “systemic risk exception” authority to provide assistance three of the four largest banking organizations: Wachovia, Citigroup, and Bank of America. Finally, the FDIC was important for its role in resolving failing banks and placing such institutions into receiverships.

- FDIC Website: Deposit Insurance Fund

- FDIC Website: Failed Banks

- FDIC Website: Crisis and Response Data Library

|

- Following the stabilization of the financial crisis, the government convened the Financial Crisis Inquiry Commission to investigate the causes of the crisis. The commission held hearings, gathered data and information and delved into the details. In February 2011, it issued its final report, which is considered the definitive report on the crisis.

- Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted on July 21, 2010, in response to the crisis. It was the most sweeping amendment to US financial regulatory system since the Depression era. The act revamped the system, eliminating the Office of thrift Supervision, assigning new duties to the FDIC and Federal reserve and creating a new consumer agency, the Consumer Financial Protection Bureau.

- The act also created infrastructure aimed at identifying risks to the stability of the financial system before they developed into a crisis, the Financial Stability Oversight Council (FSOC) and the Office of Financial Research. The Federal Reserve received new authority to regulate systemically important institutions (SIFIS) that were to be designated by the FSOC; and these could be nonbanks. To handle the liquidation of large companies, Dodd-Frank required SIFIs to submit resolution plans (living wills”) to the government and created the Orderly Liquidation Authority pursuant to which the FDIC, with its long history of resolving banks, would step in to resolve failing SIFIs.

|

| |

|